Scoring Technologies Enterprise Platform & service

We provide Next-generation credit scoring system for Traditional + Alternative Scoring.

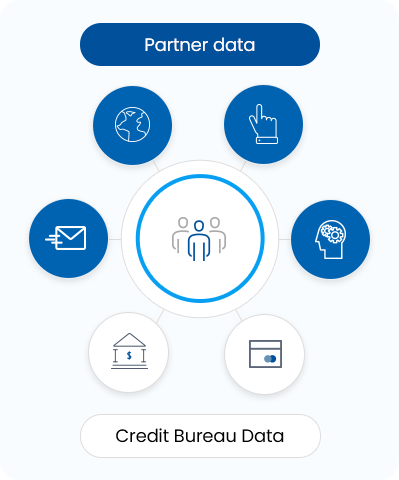

STEPs integrates all information from application, financial transaction, and alternative data for digitally automated decision.

Our patented technology, algorithms and AI Risk Manager will increase lending accuracy and improves credit decisions.

How this works

- Data Collection

- Based on client requirement, we look at various predictive tool to measure risk, income, repayment level.

- Data Analysis

- Our platform can ingest multiple data sources and provide a score or a decision back to you.

- Score Generation

- Our Data Scientists will find and build the right solution for you, reviewed monthly and calibrated as required.

- Score Application

- Our team of experts will get you set up, troubleshoot any issues and provide analytic support and advice.

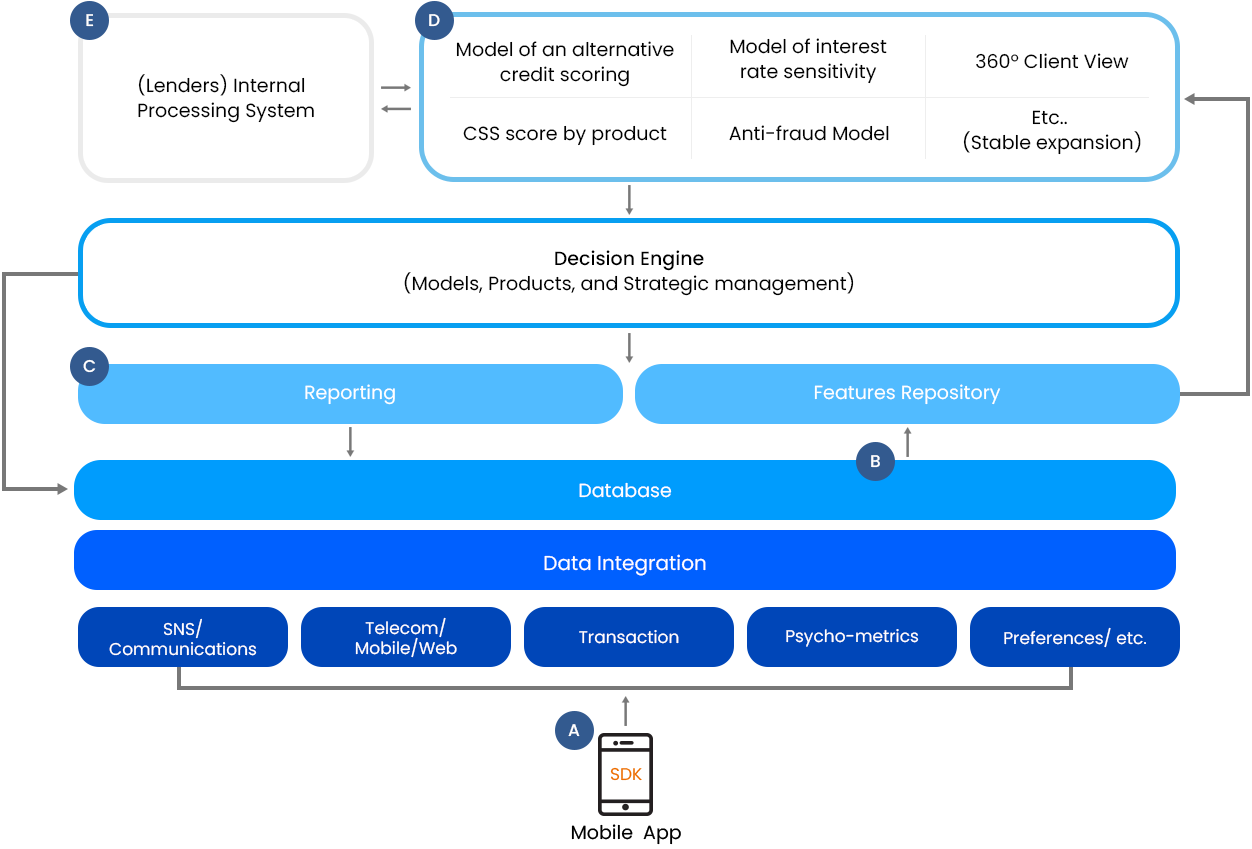

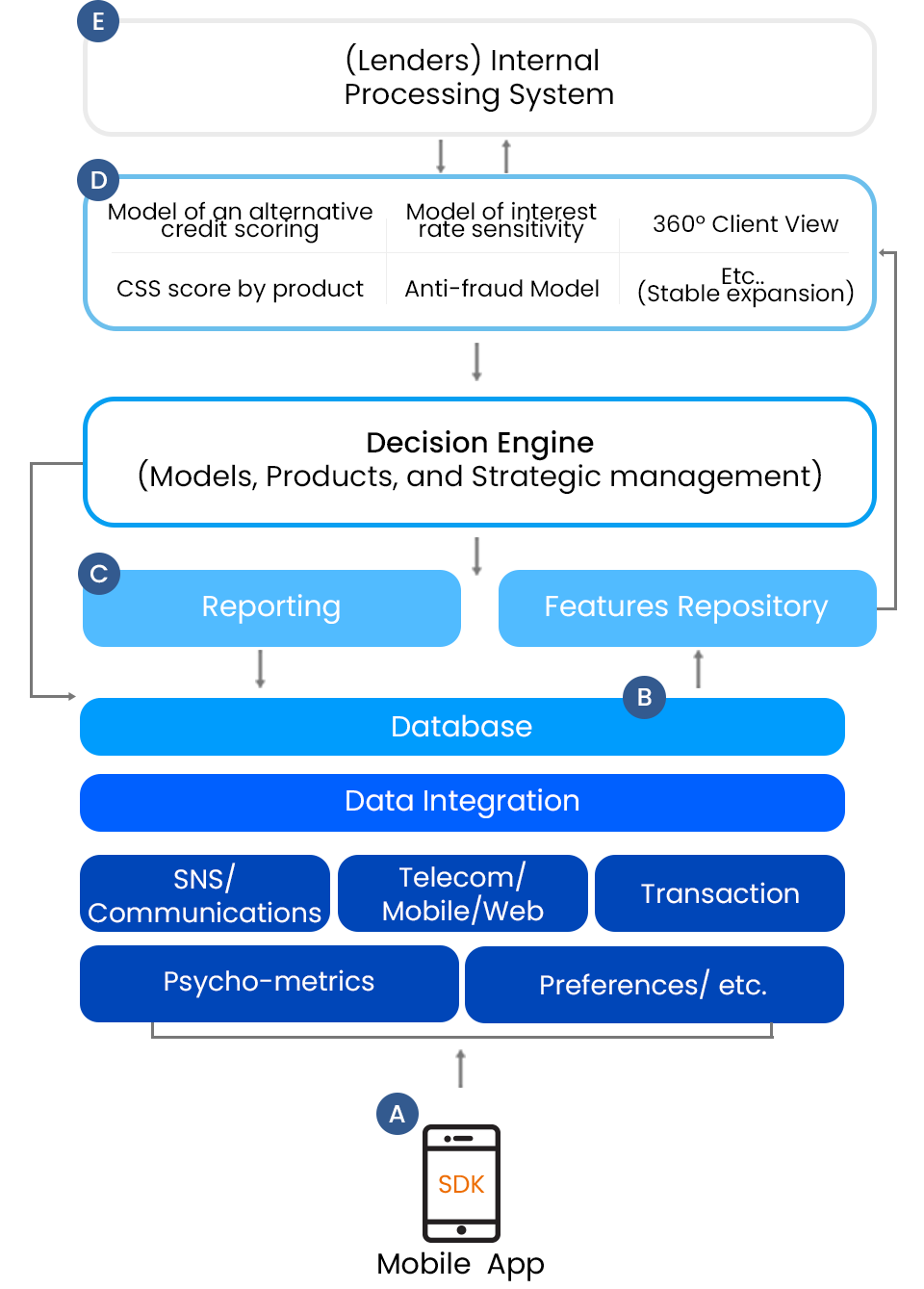

CrePASS platform overview

STEPs®

Mobile app data capture

- Capture of Digital Footprint, Mobile Behavior and Psychometric data.

Features generation/update

- Generating meaningful features based on internal/external big-data. (Using ML/AI techniques)

- A continuous upgrade with meaningful variables.

Models/Products/Strategic Management & Monitoring

- Installation and automatic management of various analysis models.

- Creating and managing results and analytical reports.

Patented Technology

- Composition of a build, test and research platform. (Partnership & Revenue sharing base)

- Continuous upgrade of the models incorporating the outcomes from both domestic and international projects.

- Implementation of a country-specific information interface and localization.

- Continuous addition of new techniques. (Expansion)

Connect to loan processing system

- Customer behavioral analysis and segmentation.

- Match of loan products considering customer characteristics and tendency.

- Individualized marketing strategy based on a client analysis. (Curating Financial goods)

Alternative information based on the CrePASS Band

Capturing Consistency | Diligence | Meticulousness through a

Big data behavioral science model

Complete multi-faceted evaluation by expanding alternative data sources

Telco

Mobile

PG

MZ Score

OCEAN Model

(FFM)

E-commerce

purchasing behavior

Mileage points

accrual/usage

Start-up Alt. finance

(BNPL, Monthly rent)

Destination preference

Health

management history

Motorcycle

driving records

Personality

assessment model

- Openness

- Adventurous, curious, creative

- Conscientiousness

- Effort to reach a goal

- Extraversion

- Effort to reach a goal

- Agreeableness

- Being inclined to be cooperative

- Neuroticism

- Emotion of Anger, Depression and anxiety